Abdurrahman Arum Rahman, October 22 2022

Global Currency Initiative (GCI) proposed a blueprint reform of a shared and science-based international monetary system managed by all (member) countries in the world democratically and decentralized. We call the blueprint an “organic system”. The organic system issues a cross-border payment instrument in the form of a real international currency, called “organic currency”. The organic currency is only for international transactions between member countries. Domestic transactions continue to use their respective national currencies. Non-member countries cannot use organic currency. Organic and national currencies can be converted to each other through an auto-balancing exchange rate, which follows the economic fundamentals of each country. The organic system is a complete package. It provides international liquidity to all member countries free of charge and sustainably, aligns macro-fundamentals, eliminates global imbalances, eliminates the potential of currency crisis at the root, and makes the international monetary system more equitable, balanced, and naturally stable. The organic system utilizes digital technology, automation, and decentralization. The organic system can start anywhere in the world and any country may join without the need for comprehensive economic integration.

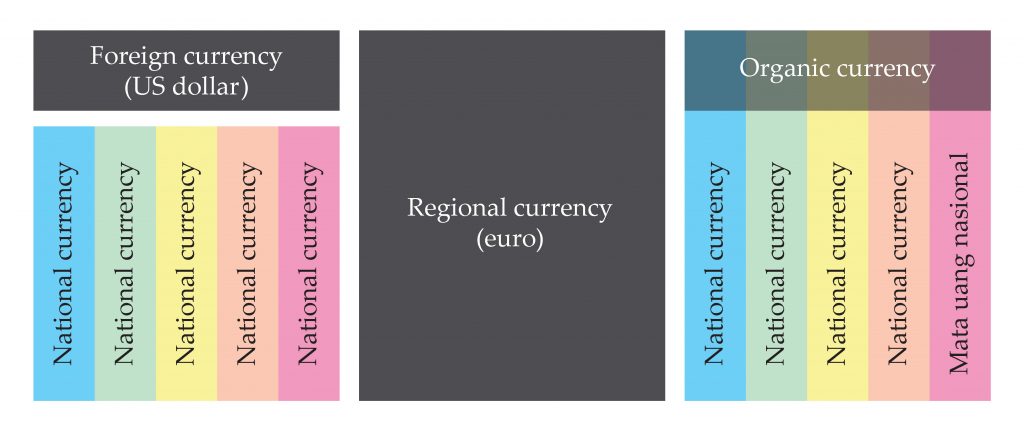

To this day, the world does not yet have a real international currency. The US dollar and euro are not real international currencies, but the currencies of the United States and the Euro Area, which are “adopted” into international currencies. The use of the US dollar and the euro as international currencies has made the world economy inequitable from the very beginning. Some countries print money while others buy the money.

Consequently, the US and the Euro can get resources from around the world simply just by printing money out of scraps of paper at almost no cost. They buy gold with paper. On the other hand, all countries in the world buy paper with gold. Trillions of US dollars of real resources and wealth flowed from all corners of the world to the countries printing international currencies, which are the richest countries in the world, free of charge, for decades.

This inequitable international monetary system from the very beginning has a long tail. Nature does not like inequality. The whole system becomes unstable and cannot be stable because of it. It should be noted that the global monetary and financial system is the lifeblood of world economic activity. When the lifeblood is inequitable and unstable, the world economy is also unbalanced, unstable, and vulnerable to crisis. For decades, dozens of crises occurred in various parts of the world regularly. The peak was the 2008 North Atlantic crisis or better known as the 2008 global crisis centered on the United States and then spread to Europe.

In response to this, on June 6, 2009, the United Nations established the commission of expertsconsisting of the best experts, practitioners, and policymakers in their fields from around the world (United Nations, 2009). The committee issued a report stating that the 2008 global crisis and other major crises stemmed from the faulty structure of the current global monetary and financial system. They give a very strong statement that the economic crisis is not just a random accident. The crisis is human-made, the fruit of the economic, monetary, and financial structure of the world.

The committee of experts chaired by Professor Joseph Stiglitz, winner of the 2001 Nobel Prize in economics, recommended fundamental and comprehensive reforms of the global monetary and financial system. More or less the same recommendations were made by other international bodies such as the IMF (IMF, 2010) and (IMF, 2011), World Bank (Lin, Fardoust, & Rosenblatt, 2012), Asian Development Bank Institute (ADBI, 2014), and other think-tanks such as (The Palais Royal Initiative, 2011), CEPR, (Center for Economic and Policy Research, 2011), and many others. In addition, some prominent economists around the world also proposed reforms of the global monetary and financial system (Zhou, 2009), (Stiglitz & Greenwald, 2010), and (Ocampo, 2017).

We, the Global Currency Initiative, proposed a blueprint reform for an equitable, balanced, and stable international monetary system. We designed a science-based international monetary system that is jointly managed by all member countries in the world called an “organic system”. The organic system is an international currency system that is jointly developed by all member countries in the world and becomes part of their respective national currencies. The system issues a cross-border payment instrument called organic international currency. The organic currency is only for international transactions between member countries. Domestic transactions continue to use their respective national currencies. The relationship between international and national currencies is organic (to be part) and hybrid (convertible). The organic currency is digital, using (semi)automated and (semi) decentralized technologies.

Therefore, naturally, the organic currency is a real international currency. It is intended to be a means of cross-border payment. It is also managed by all member countries for international interests, world interests, not for the national interests of certain countries. This is in contrast to the adopted international currencies such as the US dollar and the euro. Both are managed by the US and the Euro respectively for the benefit of these countries and regions, not for the benefit of the world. This makes a huge difference to the functions, benefits, and stability of international currencies in particular and the world economy in general.

Please note that the organic system is a complete package. It provides foreign exchange reserves (international currencies) for all member countries in the world free of charge, maintains a balance of balance sheets between countries and aligns the macro-fundamentals, stops trade wars, and eliminates the cheap competition or the race to the bottom and trapped at the bottom. It also frees the countries in the world from the bondage of foreign debt and foreign ownership, makes the international monetary system balanced and stable, and finally lifts the currency crisis to its roots.

The organic system makes world economies more coherent. The organic system uses a flexible exchange rate following the economic fundamentals of each country, called auto-balancing, so that it does not require economic integration. Thus, all countries in the world, in principle, can join, without the need to overhaul the monetary system, without losing their national currency, without losing their national identity, and without losing their national economic and monetary sovereignty.

The organic system can also start on a small scale such as ASEAN, South Asia, East Asia, Middle East, Latin America, East Africa, West Africa, Central Africa, and other regions; can also start on a combination of several regions. Other countries may join later. Every country in the world is free to choose whether to join the organic system or remain in the current (non)system. Because the essence of democracy is to provide choices.

White Book

1 Problems in International Monetary System

Our international monetary system seeds fundamental problems from the very beginning. The most classic problems were presented by John Maynard Keynes and Robert Triffin. According to Keynes, the international monetary system before and after Bretton Woods naturally caused an asymmetric-adjustment problem in which deficit countries had to turn into a surplus for their economy to sustain, while surplus countries did not. Of course, this adjustment is irrational because for deficit countries to have a surplus, surplus countries must be in deficit (Keynes, 1969).

Then Robert Triffin discovered another serious problem in the Bretton Woods system that pegged the US dollar to gold. In the Bretton Woods system, the US government must save gold for every dollar circulating abroad. Meanwhile, the US dollar is the international currency. The demand will go up. Then the price of gold will go up. The US government will not be able to provide gold reserves for every dollar circulating overseas. The larger the international transaction and the more demand for US dollars, the lower the confidence in the dollar (Triffin, 1978).

This problem is then known as the “Triffin dilemma”. In the current international monetary system, where the US dollar is no longer guaranteed by gold, but by the US economy itself, Triffin’s dilemma persists. The reason is that the size of the world economy is growing faster than the US economy. The larger the world economy, the weaker the confidence level of the US dollar. For decades, from the Bretton Woods to the modern era, no solution for these two fundamental problems.

Apart from these two classic problems, there are at least 10 other fundamental problems in the current international monetary system.

1.1 Buy paper with gold

Our international monetary system is inequitable from the very beginning. Some countries (USA) print international currency and other countries (all countries in the world) buy the money. Countries that print money can buy anything from all over the world with just a piece of paper. They buy gold with paper. Instead, all countries in the world buy these sheets of paper with gold (Rahman, 2022a, pp. 21-26).

From IMF data (IMF, 2022), as of the 2nd quarter of 2022, the total foreign currency held worldwide is 11.17 trillion US dollars equivalent. This means that the total resources and real wealth sent “for free” by all countries in the world to countries that print international currencies reached 11.17 trillion US dollars. All countries in the world “donate” their resources and wealth for free to countries that print international currencies worth 11.17 trillion dollars for decades. This is a very large number and is a major source of inequality between countries globally. The largest inequality structure that exists on earth and persists in the modern era is the international monetary system.

1.2 Wasteful foreign exchange reserves

The foreign exchange reserves are the “nation’s wallets” that contain international currencies and assets. The foreign exchange reserves aim to meet the liquidity needs of cross-border transactions and as the “fortress” of the economy from external shock.

Foreign exchange reserves are unproductive and wasteful assets because they cannot be utilized for domestic transactions. Foreign exchange reserves do not drive the domestic economy. While the maintenance costs are very expensive. In deficit countries or slight surpluses, foreign exchange reserves come from interest-bearing foreign debt. Meanwhile, in large surpluses countries, foreign exchange reserves are purchased by the state using domestic debt with higher interest rates. This means that the cost of piling up foreign exchange reserves is very expensive, both for surplus and deficit countries. Developing countries on average spend 1% of GDP on the cost of maintaining foreign exchange reserves (Rodrik, 2006).

1.3 International currency depreciation: the “donation of the poor to the rich”

Under normal conditions, all international currencies depreciate, an average of 2% per year, or what we usually call “inflation”. Meanwhile, under abnormal conditions, inflation could be much higher as it is today. The cause is that the country printing the money makes a deficit policy (expansionary), namely “spending more than income” to boost growth or to avoid stagnation. The shortcomings are then “closed” with debt and printing money. As a result, the money value shrinks or depreciates.

Please note that half of the US dollar circulates outside US soil. This means that half of the US budget deficit is “financed” by all countries in the world. One-fifth of the euro circulates outside the Euroland. This means that one-fifth of the Euroland budget deficit is “financed” by all countries in the world. This means that hundreds of billions of dollars in US and Euro budget deficits are actually being financed by all countries in the world.

With total world foreign exchange reserves of 11.17 trillion US dollars equivalent, the worldwide “donations” to the owners of international currencies total more than 200 billion dollars per year; 60% goes to the US, 20% goes to the Euro, and the rest goes to Japan, UK, etc. This means that all countries in the world, including developing and poor countries where some of the population are in starvation, give tribute or donations to the richest countries in the world more than 200 billion dollars per year. That is in normal condition. While in abnormal conditions, such as the current high inflation era, the number is even greater (Rahman, 2022a, pp. 37-42).

So far, what most people know is that the richest countries, regularly, provide donations and grants to poor countries through various programs. The total is several tens of billions of dollars per year. This donation is actually much smaller than the donation of poor and developing countries to the richest countries, which annually reaches hundreds of billions of dollars. In our real world, not rich countries donate to poor countries, but poor countries donate to rich countries. This is an ugly truth.

1.4 Global-scale trade war

The nature of trade is perfect reciprocity. All sales must come from purchases. If, in a closed market, the traders sell 1 million dollars, then the buyers must spend also 1 million dollars. If some countries in the world make a trade surplus of 1 billion dollars, then other countries must make a total deficit also 1 billion dollars. It’s impossible for every country to be a surplus.

Currently, all countries know that a surplus is more favorable than a deficit. With a surplus, they can boost economic growth and collect foreign exchange reserves. Meanwhile, those with deficits experience the opposite. So, naturally, all countries are fighting for a surplus.

As all countries pursue surpluses and avoid deficits, naturally a “mass trade war” ensued i.e. fighting over the surplus and avoiding the deficit. All countries in the world that conduct international trade are, actually, involved in this mass trade war.

The current trade war between the US and China is only the “tip of the iceberg” that is on the surface. Underneath, there is a real mass trade war, a far bigger war, involving all the countries of the world.

The massive trade war gave birth to the phenomenon of cheap competition between countries or better known as the race to the bottom. In trade wars, everyone loses. They are like a “stack of woods in a fire” or “winners be charcoal and losers be ashes” in Indonesian and Malaysian idiom (Rahman, 2022a, pp. 42-56).

1.5 Race to the bottom and trapped at the bottom

The trade war drags all countries in the world to “cheap competition”. To sell cheap goods abroad, they lowered the minimum wage, lowered foreign corporate taxes, and lowered environmental standards. All of those are for the sake of trade competitiveness and to attract foreign investment. This phenomenon is known as the race to the bottom and trapped at the bottom. Many research results show empirical evidence of this phenomenon (Davies & Vadlamannati, 2013), (Mooij, Klemm, & Perry, 2021), and (Naughton, 2014).

The race to the bottom and trapped at the bottom impose wide-range losses on a different spectrum. The winning countries suffer little loss. While the losing countries suffer a lot of losses. The losing countries end up trapped in unpaid foreign debts and they do not plan to pay them off. As a result, their growth slows down and the economies are vulnerable to crises (Rahman, 2022a, pp. 56-105).

The most striking indicators of the race to the bottom and trapped at the bottom are slowing economic growth, rising inequality, and persistent environmental degradation. All these indicators exist in the majority of countries in the world.

1.6 Foreign debt trap

The need for foreign exchange reserves always increases following the increase in international trade. When international trade increases, foreign exchange reserves must also increase so that there is sufficient liquidity for transactions. Meanwhile, the original source of foreign exchange reserves is the trade surplus. Then there was a struggle for a global trade surplus or a trade war. All countries want a surplus and avoid a deficit.

In trade, it is impossible for all countries to have a surplus. There must be deficit countries so that other countries can surplus. The result is that 1/3 of the world’s countries have a surplus and the remaining 2/3 are in deficit (The World Bank, 2020).

Deficit countries then seek foreign debt to surplus countries or to countries that print international currencies (US and Euro). Debt contains interest costs that must be paid in the future. With trade deficits and future interest expenses, these countries are finally trapped in foreign debts that “can never be paid and are not planned to be paid”. They are entangled in eternal global loan sharks (Rahman, 2022a, pp. 105-112).

1.7 Middle-income trap

Almost all developing countries, at some level, are slowing down. They are very difficult to level up to a high-income level. They are trapped in the middle or what we know “middle-income trap” (Gill & Kharas, 2007).

In today’s trade, more-competitive countries can exploit the market of other less-competitive countries and become rich countries in that way. Meanwhile, the exploited countries slowed down. They are “lagging on the runway”. In fact, due to the race to the bottom and trapped at the bottom as described above, all countries, both winners and losers, also slowed down. Then there is a phenomenon of a middle-income trap. The economic growth of almost all developing countries is slowing down (Rahman, 2022a, pp. 112-133).

Developing countries are competing to become rich countries through a narrow road. Almost all countries are stuck in the middle of this narrow road. Their growth is slowing down. There is no rational way that can make all those developing countries grow fast together on such a narrow road.

1.8 Global imbalances

Most experts define global imbalances as current account imbalances or balance of payments (BoP) imbalances. Since the current account is accumulative in nature, global imbalances are also accumulative and sediment in the national balance sheet or what we know as the Net International Investment Position (NIIP). NIIP is the broadest and deepest indicator of global imbalances.

Most of the balance sheets (NIIP) of countries in the world are unbalanced. Some of them are in surplus and most of them are in deficit. They are like ships tilted to the left or to the right. This phenomenon is called “global imbalances”. Global imbalances make the economies of the world unstable and vulnerable to crises.

Two main factors cause global imbalances. First, our current international monetary system is not symmetrical, that is, some countries print money while others buy the money. This creates a permanent global imbalance. Countries that print money must have a large deficit so that the currency circulates abroad while the user countries must have a surplus to collect foreign exchange reserves.

Second, the world does not have an accurate exchange rate mechanism. The exchange rate policy is left to the respective countries without adequate supervision. Meanwhile, some countries practice mercantilism, which is lowering the exchange rate of the national currency to encourage exports as much as possible to boost economic growth. As a result, their trade surplus is large while other countries are in deficit. In this way, global imbalances also spread among the peripheral countries (users of international currencies) themselves. A small number of countries have very large surpluses, and the rest are in deficit.

Deficit countries end up trapped in unpaid foreign debt. Their economy becomes vulnerable and unstable. They are like tilted ships. Since the world economy is, in principle, a giant ecosystem, the entire world economy is ultimately unstable.

Global imbalances are cumulative in nature. Since the current accounts of countries with surplus and deficit tend to be long-term and there are no signs of a major trend reversal, global imbalances are always increasing. Global imbalances are fertile grounds for currency crises (Rahman, 2022a, pp. 133-168).

1.9 Fluctuation and instability

The exchange rate between currencies around the world fluctuates. It makes the entire system unstable. The main cause is transactions that do not have an underline or what we know as “noise transaction” or “speculation” that dominates world money markets. Based on (BIS, 2019) data and (WTO, 2021), more than 99% of money transactions worldwide do not have an underline. While speculation increases volatility (De Long, Shleifer, Summers, & Waldmann, 1990). In this way, exchange rates around the world are volatile and very unlikely to be stable. Fluctuations increase cross-border transaction and business costs, increase the risk of uncertainty, and destabilize the entire system.

The size of speculation in global money markets is always increasing. Thus, the main potential cause of volatility also increases. The international monetary system and the world economy are increasingly unstable. Speculation is the triggering factor for the currency crisis (Rahman, 2022a, pp. 168-186).

1.10 Currency crises

The currency crisis is the culminating failure of the international monetary system. It is an accumulation and combination of many failures. In user countries (that use international currencies), the currency crisis is usually accompanied by a financial crisis and in many cases escalates into an economic crisis.

A crisis is like an earthquake. When the energy of imbalance continues to grow and the economic structures are unable to withstand it, then one or some of the structures break(s), releasing energy, and a crisis occurs. In the unbalanced condition, speculation becomes an active factor and tends to be self-fulfilling. Speculation can make the crisis happen earlier when the economic structures are still strong (Rahman, 2022a, pp. 168-210).

Internal imbalances give rise to financial crises. External imbalances give birth to currency crises. Both can escalate into economic crises. For user countries (that use international currencies), both currency and financial crises have the same outcome.

As the trend of imbalances and speculations increases, the crisis trend also increases. Until now, the crisis has no cure.

2 The Organic System

2.1 Brief description

The organic system is an international monetary system jointly developed by all member countries in the world and becomes part of their respective national currencies. The system issues cross-border payment tools called organic currency. The organic currency is only for international transactions between member countries. Domestic transactions continue to use their respective national currencies. The relationship between international and national currencies is organic (to be part) and hybrid (interconvertible). The exchange rate between the organic currency and the national currency uses an “auto-balancing” that fully follows the economic fundamentals and a neutral balance sheet of each country. The organic system uses digital technology, automation, and decentralization.

Differences with the US dollar

The US dollar is issued and controlled by the US government. Countries in the world only use (buy/rent) but cannot control it. Meanwhile, the organic currency is issued and controlled by all member countries. Member countries do not need to buy. They get allocations for free, based on need.

Differences with euro

The euro is a single currency in the Euro region. There is only one currency in the region. There is no national currency. Meanwhile, organic currency coexists with the national currencies of all member countries.

The euro is issued and controlled by the Euro. Countries in the world only use (buy/rent) but cannot control it. Meanwhile, the organic currency is issued and controlled by all member countries around the world.

Differences with a single currency

The single world currency is a concept where there is only one currency in the world. There is no national currency. Domestic and international transactions use a single currency. Meanwhile, the organic currency coexists with the national currencies of all member countries in the world. Organic currency is only for international transactions, not for domestic transactions.

2.2 Governance

Member countries establish an intergovernmental body, for example, the United Nations of International Monetary (UNIM). Ideally, UNIM is under the auspices of the United Nations. Then, the UNIM founds the World Central Bank (WCB) and oversees its journey. The WCB runs the entire system and is responsible to UNIM.

The WCB has representative offices in each member country called the World Central Bank National (WCBN). The daily operations of the organic system in WCBNs. The WCB is only an administrative office where the main policies are made.

WCBNs cooperate with the National Central Bank (NCB) of each member country. WCBNs regulate the international monetary system while NCBs regulate the national monetary systems. Thus, each NCB is fully independent in regulating the national monetary system of each country.

Each WCBN and NCB operates at least one supercomputer, which is the core of the decentralized system.

There are two alternatives to financing the organic system. First is member countries’ contributions. The amount of the fee follows the amount of organic currency used in each country each year. The second is the world central bank service fee for the public and other business entities.

The voting rights are proportional to the amount of organic currency used in each country.

The organic system is a closed system. Only member countries can utilize the services and the organic currency.

The membership is open. All countries in the world can register to become members without requiring comprehensive economic integration.

2.3 Organic and hybrid

The organic currency does not stand alone and is not a foreign currency, but becomes part of the national currency of each member country. Each unit of organic currency is secured by the national currency; so it does not require gold collateral and other international assets.

Organic and national currencies are hybrid. They can be converted from one to another without spreads and do not affect the price (exchange rate). For example, if the purchase price of the organic currency is 100 Indian rupees per unit, then the selling price is also 100 rupees. There is no money exchange cost. The exchange of money also does not change the exchange rate, regardless of the amount. Because the exchange rate only follows economic fundamentals as will be explained later in the exchange rate section. The public can exchange money directly at the central bank using their respective accounts as will be explained later in the section on digitization, automation, and decentralization.

2.4 Value

Organic currency is not attached to the state budget of any country in the world and is not related to the competitiveness of any country. Therefore, the value of the organic currency can be completely stable, that is, it does not increase and does not decrease at all, or zero depreciation and zero appreciation or zero inflation. To achieve this stable value, the organic currency is pegged to the global price index.

Thus, the value of the organic currency will be “super stable”, unchanged both in the short and long term, more stable than all types of currencies that have ever existed on earth, including gold.

2.5 Ideal amount

Each member country gets an organic currency allocation based on the need for international transactions between member countries. We have two alternatives for allocation, namely (1) Keynes’s recommendation of 1 year of international trade or (2) the rule of thumb for industrialized countries of 3 months of trade needs. The ideal amount is open to future discussion.

The ideal amount is not a quota. This means that member countries can still use organic currency over the ideal amount.

It should be noted that the use of organic currency above the ideal amount is, in principle, detrimental to the country itself. The reason is the auto-balancing exchange rate system. In auto-balancing, excessive use of organic currency for imports is not possible. Further explanation is in the section on exchange rates. Thus, excessive use of organic currency will reduce the use of national currency. Since organic currency is under the control of the world’s central banks, this will decrease the control of national central banks over national monetary. To avoid excessive use of organic currency, member countries’ governments can utilize tax as explained later in the control section.

2.6 Issuance from world central bank nationals to national central banks

The issuance of organic currency is direct with the national currency collateral in each member country as below:

1. WCBN issues organic currency to NCB in the ideal amount as described above.

2. As collateral, NCB sends the national currency to WCBN.

Thus, every unit of organic currency issued in all member countries is guaranteed by the national currency. Therefore this system is called organic, where the international currency does not stand alone, but becomes part of and is guaranteed by the national currency, in each member country.

The amount of collateral is always the same as the organic currency issued in each country. If the value of the national currency depreciates against the organic currency, then NCB sends the shortfall to WCBN so that the value (of collateral) is the same again. Vice versa, when the national currency appreciates against the organic currency, then WCBN returns the excess to NCB so that the value is the same again.

The national currency collateral is kept by WCBN in the form of notes, does not need to be printed, and is not circulated. Thus, no economic or monetary costs in this collateral system. This makes the organic currency issuance system very efficient, requiring no collateral for gold or other international assets.

2.7 Distribution to the public

Distribution

People who need organic money for transactions between member countries can directly buy from the national central bank with the national currency through their respective accounts. The public can create an account directly at the central bank as described later in the section on digital, decentralization, and automation. The revenues from the sale (seigniorage) become government revenue.

Withdrawal

People that no longer need organic money can directly sell it to the national central bank. Purchase costs (negative seigniorage) become government costs.

2.8 Control system

Passive control

When the amount of organic currency in circulation is within the “ideal amount” as described above, control is left to the market. The government or central bank does not intervene at all. So the central bank only accepts purchases and sales from the public.

Active control

When the amount of organic currency in circulation exceeds the “ideal amount”, the government exercises active control. The government can implement regulation or “taxation of holding organic currency”. Tax revenues become the government’s revenue of each country.

We call this “direct control”. Direct control is very efficient and does not require interest at the central bank or government level. Thus, the organic currency is not interest-based and not interest-bearing money; there is no interest rate at the central bank or government level (zero interest rate). We believe this direct and interest-free control system is much more efficient than the interest-based control system that is currently practiced by many central banks.

2.9 Digitization, automation, and decentralization

To maximize functionality, the organic currency is digital, using automated or semi-automated and decentralized or semi-decentralized technologies (Rahman, 2022a, pp. 300-310) and (Rahman, 2022b). Digital currency is a currency that is “printed”, stored, and managed in the form of a “digital code”. Automation is a process or technology that runs on its own without human intervention or with minimum supervision. A decentralized system is a system that is built with many cores so that it does not depend on one particular center.

The advantage of decentralization is that the system remains fully functional even if some parts or cores are disrupted. All member states are cores. All supercomputers run by each country are also cores. When some cores in various countries are broken, the system can still work well with other still-active cores.

Core

Organizationally, member states are the cores. WCB, WCBNs, and NCBs are all cores. They are all equal. Technically, all supercomputers run by WCBNs, and NCBs in all member countries are cores. One country runs at least two units or more.

Backbone

All supercomputers are connected to the main network called the backbone. The main network is an internet network. It can be exclusive or inclusive.

Client

The general public, commercial banks, financial institutions, companies, and all equipment connected to the main network to obtain organic system services are clients. Clients can access services in the organic system through the main network and accounts in central banks.

Service

The main services available to the public are account creation and maintenance, transfer, payment and settlement, and money exchange. The public can create accounts and utilize all of these services directly at the central bank.

If member countries’ fees finance the operation of the system, then all the main services are free to the public. If service fees finance the system, then the service is paid, of course at a much cheaper cost (can be dozens of times cheaper) than the current system. Because the organic system and world central banks operate on a non-profit basis and are controlled by all member countries. This makes transfers, money exchanges, and international payments and settlements very efficient.

2.10 Auto-balancing exchange rate

The exchange rate is the most important part of the organic system. It is not only a reference value for money exchange but also to maintain the balance and stability of the system. The organic system uses its own exchange rate, which is called “auto-balancing”. The auto-balancing exchange rate is an equation that works automatically (Rahman, 2022a, pp. 323-347):

E: National currency exchange rate

(PI) ̅ : Weighted average price of imported goods and services (tradable) in international currencies.

(PX) ̅ : Weighted average price of export goods and services (tradable) in national currency.

GDP : Gross domestic product in the previous year

Surplus Balance Sheet: Net International Investment Position (NIIP) – surplus

Deficit Balance Sheet: Net International Investment Position (NIIP) – deficit

The auto-balancing exchange rate consists of two components. The first component ((PI) ̅/(PX) ̅) is the “true exchange rate” at which the average price of imported goods and services equals exports. This component is a combination of the equation of money in the quantity theory of money (QTM) and the equation in the basic laws of international trade (BLIT). This component makes the exchange rate always follow economic fundamentals and is not affected by speculation.

The first component makes the average price of domestic goods and services that can be exported equal to those abroad. This makes the competitiveness or comparative advantages of all countries relatively balanced. When they trade, their trade is also relatively balanced, with neither excessive surplus nor excessive deficit. We have made a simulation to prove this in working paper 2-2022 (Rahman, 2022c).

The second component (GDP+Surplus Balance)/(GDP+Deficit Balance) is the balancing factor. This second component makes the balance sheets (NIIP) of all member countries tend to return to a neutral position. The second component makes capital and trade flows neutralize each other so that the current account and balance sheet of each country tend to be relatively neutral, not excessively surplus, and not excessively deficit. We have also simulated and proven this in working paper 3-2022 (Rahman, 2022d).

How does the exchange rate system work?

- The auto-balancing makes competitiveness or comparative advantage between countries relatively balanced. Please see (Rahman, 2022c) for further explanation and proof.

- The auto-balancing makes trade between countries relatively balanced, not excessively surplus and not excessively in deficit. Please see (Rahman, 2022c) for further explanation and proof.

- The auto-balancing makes capital flows and trade neutralize each other so that the current accounts, the balance of payments, and the NIIP of all countries tend to be relatively balanced, not excessively surplus, and not excessively deficit. This makes the foreign exchange reserves of each country tend to be self-sufficient. The further consequence is that all countries do not need government foreign debt to meet the foreign exchange reserves or they can pay it off. Please see (Rahman, 2022d) for simulation and proof.

- The auto-balancing makes the exchange rate fully follow the economic fundamentals of each member country and the relatively neutral balance sheet (NIIP). This makes the exchange rate stable, and not affected by speculative transactions. Please see (Rahman, 2022d) for further explanation and proof.

3 Solving the Problems of the International Monetary System

The organic system is a science-based international monetary system. It stands on the most basic theories in modern economics and some basic theories in physics. The main structure of the organic system is symmetrical, in which international currency is issued in each country, and all countries are equal in nature. The organic system also makes international monetary only follow the fundamental of international economic (macro-fundamentals). There is no deviation between international monetary and fundamentals. We call this a “fabric of elegant international economic” (Rahman, 2022a, pp. 445-485). In that way, in addition to providing international liquidity to all member countries in the world, the organic system could also potentially solve almost all problems in the international monetary system as mentioned above comprehensively and naturally.

The organic system can eliminate the two classic problems in the international monetary system as proposed by Keynes and Triffin. First, the organic system makes the balance of trade and the current account of each country relatively balanced. Thus, the asymmetric-adjustment problem as presented by Keynes does not arise in the first place. The system automatically makes adjustments to countries with excessive surpluses and deficits in real time. Then, second, the organic system is completely symmetrical where the international currency is issued in all countries so the Triffin dilemma does not exist. No matter how much the world needs international liquidity, the system can provide it, without creating an imbalance, and without reducing the confidence level of the international currency.

3.1 Free international currency for all member countries

In a democratic realm, anything that can be made at no cost can, in principle, be distributed to all members free of charge. And so the international currency. Member countries can create a common international currency at almost no cost and distribute it to all member countries free of charge.

The organic system is completely democratic. This system can create international currency almost at no cost and distribute it to all member countries based on international transaction needs also free of charge. They no longer need to buy international currencies or borrow overseas just to meet their international liquidity needs or foreign exchange reserves as they are now (Rahman, 2022a, pp. 383-388).

3.2 No need to accumulate foreign exchange reserves

The system provides foreign exchange reserves to all member countries free of charge. Member countries also do not need to fight over trade surpluses and do not need foreign debt to pile up foreign exchange reserves. The system provides it.

Currently, developing countries accumulate huge amounts of foreign exchange reserves to maintain the stability of their monetary systems. The cost of accumulating foreign exchange reserves is very expensive. They spend an average of 1% of their GDP to build and maintain foreign exchange reserves (Rodrik, 2006). In the organic system, these costs are no longer necessary. The system provides foreign exchange reserves and maintains them for all member countries for free (Rahman, 2022a, pp. 388-391).

3.3 The international currency does not shrink

The organic currency is completely stable, neither depreciating nor appreciating. The value of the organic currency will remain the same for the next 10 or 100 years. Thus, there will no longer be “contributions of the poor” to “the rich” in the form of depreciation of international currencies as it is now. All countries are equal. The organic system makes the international monetary and economic system more rational, equitable, and fair (Rahman, 2022a, pp. 391-392).

3.4 Eliminating trade wars

Since foreign exchange reserves are provided free of charge, all member countries do not need to pursue trade surpluses. Then, with the auto-balancing exchange rate, the competitiveness and trade of all member countries are relatively balanced, with no excessive surplus and no excessive deficit.

Thus, the trade war is irrelevant. No motive for trade wars. International trade can be more coherent. Comparative advantage in international trade theory becomes actual and can work at its best (Rahman, 2022a, pp. 392-418). Please see (Rahman, 2022c) for further explanation and proof.

3.5 Eliminating race to the bottom and trapped at the bottom

Since the trade is relatively balanced, then the motive in the race to the bottom and trapped at the bottom becomes irrelevant. Investment sector as well. There is no motive for an unhealthy scramble for foreign investment. The state (government) does not need to lower labor wages, lower foreign company taxes, and lower environmental standards to compete in trade and pursue investment. There is no motive for unfair competition. Without motives, countries in the world can avoid unfair competition in the form of a race to the bottom and trapped at the bottom. The international economy is more likely to form a mutual relationship (Rahman, 2022a, pp. 418-424).

3.6 Pay off the government’s foreign debt

Since foreign exchange reserves are provided and the current account is relatively balanced, the government’s foreign debt is irrelevant. Foreign debt for the private sector may still be necessary with the business model. But, government debt to foreign countries is completely irrelevant and useless. Therefore, the governments of member countries do not need to owe abroad. If they are already in debt, they can make plans to pay it off as well. The organic system could potentially provide ways and resources to pay off the foreign debts of all governments of any country in the world, regardless of the amount. This notion (paying off the government’s foreign debt) may still require further research, although the simulations in our working paper number 3-2022 (Rahman, 2022d), implicitly, and the case examples in the book (Rahman, 2022a, pp. 426-427), explicitly, allow this hypothesis.

3.7 Eliminate the external factors of the middle-income trap

As mentioned above, three external factors lead to the middle-income trap, namely (1) trade exploitation, (2) the race to the bottom and trapped at the bottom, and (3) huge and expensive foreign exchange reserves. The organic system can eliminate all these 3 external factors comprehensively. Thus, the organic system can eliminate the external factors that cause the middle-income trap. In the organic system, developing countries do not compete on a narrow and jostling road. Each of them has its own road. They could potentially grow faster (Rahman, 2022a, pp. 429-435).

3.8 Eliminate global imbalances

The organic system can eliminate the two main structures of global imbalance (Rahman, 2022a, pp. 435-439). First, the organic system is symmetrical, i.e. international currency is issued in all member countries. Thus, the first structure of global imbalances (asymmetrical issuance system) can be eliminated. No matter how much the world needs an international currency, the system can provide it to all countries without creating imbalances. The world doesn’t need any country to be in a deficit just to provide international liquidity for other countries.

Second, the auto-balancing exchange rate keeps the trade and balance sheets of each member country relatively balanced. The auto-balancing also makes capital flows and trade neutralize each other (Rahman, 2022d). So, no country can do mercantilism (trade exploitation by making a large surplus) in any way. The exchange rate system will neutralize it in real-time. Thus, no country has an excessive surplus and an excessive deficit. This has implications for the foreign ownership balance. No country can control the assets of other countries excessively and no country whose domestic assets are controlled by foreigners excessively too. Foreign ownership is still possible but with relatively balanced ownership. In this way, the organic system can decompose even the extreme foreign ownership. In the example case (Rahman, 2022a, pp. 438-439), we explain how the system decomposes extreme and “stifling” foreign ownership.

3.9 Eliminate fluctuations and instability

The organic system eliminates two main sources of instability, namely imbalances and speculations. First, by making the balance sheets of all member countries relatively balanced as described above, the organic system can eliminate the first source of instability, namely global imbalances.

Second, the auto-balancing exchange rate keeps the exchange rate relatively stable and fully follows the fundamentals. Please see the working paper 3-2022 (Rahman, 2022d) for further explanation and proof. In the organic system, the exchange rate is a mirror of the fundamentals. Noise transactions or speculation do not affect the exchange rates. Then, naturally, the speculation will go away or at least have no effect. Naturally, the system becomes more stable (Rahman, 2022a, pp. 439-442).

3.10 Eliminate currency crises at their roots

By eliminating global imbalances and currency speculations and making exchange rates relatively stable, the organic system could potentially eliminate currency crises to the roots. Theoretically, no currency crisis in the organic system (Rahman, 2022a, pp. 442-444). We call this a “fabric of elegant international economic” where the international monetary fully follows the economic fundamentals, with no deviation, and no currency crisis (Rahman, 2022a, p. 445).

4 May Start From Anywhere and Can Be Initiated By Anyone

Dozens of ideas for international monetary reforms and initiatives have emerged in various parts of the world. However, all those ideas stopped in the middle of the road. They all hit the “great impenetrable wall”. At least, two major factors or great walls stop them all, namely (1) the requirements for comprehensive economic integration and (2) the “top of the pyramid” agreement.

4.1 First, comprehensive economic integration

One of the most popular forms of shared international currency is the single currency model such as the euro. Developing a euro or the like requires comprehensive economic integration. If these requirements are not met, then combining the currencies can cause imbalances. The result can be fatal. Countries experiencing imbalances may suffer greater losses than gains. Meanwhile, achieving comprehensive economic integration is not easy. From various research results, there is no single region in the world that currently fulfills these requirements better than the Euro and the US. So, developing a regional or international monetary system like the euro is very difficult.

Please note that the organic system does not require comprehensive economic integration. The reason is that the organic system uses a fully flexible exchange rate following economic fundamentals. The auto-balancing maintains relatively neutral balance sheets of all member countries in all conditions. Then, comprehensive economic integration is not necessary. All countries can join as they are without requiring comprehensive economic integration. Therefore, the organic system can develop anywhere in the world and all countries can join without the need for comprehensive economic integration (Rahman, 2022a, pp. 509-511).

4.2 Second, the “top of the pyramid” agreement

The idea of global currency and international monetary reform has been around for decades. The most popular is the bancor proposed by the Father of Modern Economics, John Maynard Keynes at the Bretton Woods conference in 1944. After Keynes, dozens of other ideas emerged later. However, all the ideas for global or international currencies stopped because they did not get approval from the “top of the pyramid”, especially the United States. Keep in mind that the US is the most important player in the world. The US is the owner of the most dominant (adopted) international currency. When the US did not agree, the idea immediately hit a great wall.

The problem is that all ideas of an international currency can only work if it gets the approval and support of the major players. The idea of an international currency can only work if all the major player countries or the “top of the pyramid” sit at one table and share very basic interests. And we all know that is impossible; at least in the foreseeable future. Maybe in the age of Star Trek, they could all sit at one table.

The organic system works in a different way. This system can start on a small or large scale and can function normally regardless of the number of members. The organic system can start anywhere in the world regardless of the number of members without requiring the approval or agreement of the “top of the pyramid countries”. If the major player countries agree and join the system, then that is great, but otherwise, it does not matter. Countries that have agreed can still continue the initiative and the system can still run.

With the two characteristics above, namely, (1) does not require comprehensive economic integration and (2) does not require the cooperation of all countries, but only countries that support it, the organic system can be free from the “global monetary cartel”. The organic system can develop anywhere and any country or any region around the world can start the initiative. Even with a small number of members, for example, ASEAN countries, East Asia, South Asia, Middle East, West Africa, East Africa, Central Africa, Latin America, and so on, the organic system can function normally. Furthermore, the organic union can open up to all countries in the world. All countries can join later.

Without the requirements of comprehensive economic integration, without losing the national currency, the organic union will grow naturally. It will roll like a snowball. In the end, all countries will join. We believe, it is only a matter of time.

5 Bring the Idea to Life

5.1 Global currency initiative

To materialize the organic system, we develop the “Global Currency Initiative” (GCI). The final goal of GCI is to develop a truly international currency and a world central bank that are managed by all member countries in the world in a democratic and decentralized manner. To achieve this goal, GCI makes the following pilot programs:

- Research and development of models, theories, and technologies in the fields of economics, information, politics and international relations, and other fields as needed

- Education

- Publication

- Inviting all parties and governments to join

GCI is a non-profit and open research body or “think tank”. It can be developed anywhere in the world. GCI also uses the principle of decentralization. This means that each agency established in each country is independent and in coordination with each other. GCI’s medium target is to invite governments in the world to get involved.

5.2 When the governments get involved

After getting involved, the governments of the countries in the world can take control. They can form an intergovernmental body, the United Nations of International Monetary (UNIM). Ideally, the UNIM is under the auspices of the United Nations and coordinates with the IMF.

UNIM membership is voluntary and open. All countries can join. The voting rights of each country are based on the size of international trade and other current account transfers. UNIM’s main task is to establish a world central bank and prepare all the necessary regulations.

In fact, the IMF is more than sufficient to become an international organization that houses the organic system. However, considering that the IMF already has its own decision-making system, it may be difficult to accommodate. In addition, not all IMF member countries will join in the early stages. So, it would be more effective, for the organic union to form its own international body.

5.3 Establish a world central bank and create a true international currency

Our final goal is to establish a world central bank that can issue organic international currency and run the whole system. The world central bank is an executive body and is responsible to UNIM.

PDF version of this paper is available at GCI Working Paper No 4-2022.

References

ADBI. (2014). Reform of the International Monetary System: An Asian Perspective. Tokyo: ADBI. Retrieved from https://www.adb.org

BIS. (2019). Triennial Central Bank Survey: Global Foreign Exchange Market Turnover in 2019. Monetary and Economic Department. Basel: BIS. Retrieved from https://www.bis.org

Center for Economic and Policy Research. (2011). Reforming the International Monetary System. Washington, D.C.: CEPR. Retrieved from https://cepr.org

Davies, R. B., & Vadlamannati, K. C. (2013). A Race to the Bottom in Labor Standards? An Empirical Investigation. Journal of Development Economics, 103, 1-14. doi:10.1016/J.JDEVECO.2013.01.003

De Long, J. B., Shleifer, A., Summers, L. H., & Waldmann, R. J. (1990). Noise Trader Risk in Financial Markets. Journal of Political Economy, 98(4), 703-738. doi:10.1086/261703

Gill, I., & Kharas, H. (2007). An East Asian Renaissance: Ideas for Economic Growth. Washington DC: The World Bank. Retrieved from http://documents.worldbank.org

IMF. (2010). Reserve Accumulation and International Monetary Stability. IMF Policy Papers. Washington DC: IMF. Retrieved from https://www.imf.org

IMF. (2011). Enhancing International Monetary Stability—A Role for the SDR? IMF Policy Papers. Washington DC: IMF. Retrieved from https://www.imf.org

IMF. (2022). Currency Composition of Official Foreign Exchange Reserve (COFER). Retrieved from International Monetary Fund: https://data.imf.org

Keynes, J. M. (1969). The Keynes Plan; Proposals for an International Clearing Union. In IMF, The International Monetary Fund 1945-1965 (Vol. III, pp. 19-36). Washington DC: IMF. Retrieved from https://www.elibrary.imf.org

Lin, J. Y., Fardoust, S., & Rosenblatt, D. (2012). Reform of the International Monetary System : A Jagged History and Uncertain Prospects. World Bank Policy Research Working Paper. Washington, DC.: The World Bank. Retrieved from https://openknowledge.worldbank.org

Mooij, R. A., Klemm, A., & Perry, V. (2021). Corporate Income Taxes under Pressure : Why Reform Is Needed and How It Could Be Designed. Washington DC: IMF. Retrieved from https://www.elibrary.imf.org

Naughton, H. T. (2014). To shut down or to shift: Multinationals and environmental regulation. Ecological Economics, 102, 113-117. doi:10.1016/J.ECOLECON.2014.03.013

Ocampo, J. A. (2017). Resetting the International Monetary (Non)System. London: Oxford University Press. Retrieved from https://library.oapen.org

Rahman, A. A. (2022a). Initiating a True International Currency. Jember: GCI. Retrieved from https://books.google.co.id

Rahman, A. A. (2022b). A Conceptual Model for a Decentralized Central Bank Digital Currency. GCI Working Paper No 1-2022 (pp. 1-31). Jember: Indonesia. doi:10.33774/coe-2022-3t83l-v2

Rahman, A. A. (2022c). The Basic Laws of Trade. GCI Working Paper No 2-2022 (pp. 1-39). Jember: GCI. doi:10.33774/coe-2022-qjrf5-v3

Rahman, A. A. (2022d). Proposal for a Balanced and Stable International Monetary System. GCI Working Paper No 3-2022. Jember: GCI. doi:10.33774/coe-2022-s4k70-v4

Rodrik, D. (2006). The Social Cost of Foreign Exchange Reserves. International Economic Journal, 20(3), 253-266. doi:10.1080/10168730600879331

Stiglitz, J. E., & Greenwald, B. (2010). Towards A New Global Reserve System. Journal of Globalization and Development, 1(2), 1-24. doi:0.2202/1948-1837.1126

The Palais Royal Initiative. (2011). Reform of the International Monetary System: The Palais Royal Initiative. New Delhi: SAGE Publications India Pvt Ltd. Retrieved from https://books.google.co.id

The World Bank. (2020). Net trade in goods and services (BoP, current US$). Retrieved from The World Bank: https://data.worldbank.org

Triffin, R. (1978). Gold and the Dollar Crisis: Yesterday and Tomorrow. Princeton: Princeton University.

United Nations. (2009). Report of the Commission of Experts of the President of the United Nations General Assembly on Reforms of the International Monetary and Financial System. New York: United Nations. Retrieved from https://www.un.org

WTO. (2021). World Trade Statistical Review 2021. Geneva: WTO. Retrieved from https://www.wto.org

Zhou, X. (2009, March 23). Reform the International Monetary System. BIS Review 41. Retrieved from https://www.bis.org